For SaaS businesses, customer lifetime value (LTV) is one of the key metrics that needs to be tracked as part of the customer experience program. It gives you a clear indication of how valuable a customer is to your company, instead of just focusing on their first purchase. Analyzing and understanding how to calculate LTV can help SaaS businesses in developing a SaaS marketing strategy to acquire new customers and retain the existing ones. It can also help in making sure the profit margins are maintained.

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV) is the total worth of a customer to a business over the entire period of their relationship. It takes into consideration the total revenue one single customer can bring in and compares it to the company’s expected customer lifetime.

The longer a customer stays loyal to a company and continues to make a purchase, the bigger the lifetime value becomes.

Why is Customer Lifetime Value Important?

Customer Lifetime Value is a powerful metric that can help businesses align their sales, marketing, and product management processes. This can, in turn, benefit customers and increase net profits.

By measuring LTV in relation to customer acquisition costs (CAC), it also becomes possible for companies to measure ROI for every new customer that can help in estimating sales and marketing budgets.

Accurately estimating CAC with the help of LTV can also help you figure out the commissions that you can offer to your sales team for successfully closing deals. In most cases, it is recommended that customer acquisition costs be at most one third of the LTV.

Calculating the LTV to CAC Ratio:

LTV > 3 x {Sales commission + (Cost per lead x Lead-to-close ratio)}

When you regularly calculate and update LTV for every customer, and reward your sales team for how much future expected value they are bringing to the company, you are able to boost the morale of your sales team and make them feel more motivated.

LTV also helps product management teams understand the true value of your products. After all, the value of a product depends on whether the customers are buying it or not. A product cannot solely be judged by its sales numbers. It is judged on how its absence or presence can affect the LTV of the customers who buy it.

How Does Customer Lifetime Value Impact Marketing?

You will always have to spend money to acquire new customers and retain old ones. In fact, acquiring new customers costs almost five times more than retaining existing ones. Moreover, while the probability of selling to an existing customer is 60-70%, the chance of selling to a new customer is just 5-20%.

By clearly estimating LTV, marketing teams can focus more on targeting qualified leads who can be easily acquired with the lowest costs.

For instance, spending $10 acquiring a lead that ends up buying more than $500 of products may seem like a great bargain. But what if your close ratio was 5%? You would have to spend $10 x 20 leads = $200 just for acquiring one customer who would buy your product worth $500.

A clear LTV helps set the maximum marketing budget for both acquiring new customers, and for maintaining relationships with existing ones.

It is also important for marketing teams to understand that, just like there isn’t a simple target segment, there also isn’t just a single LTV number. Instead, they need to segment their marketing efforts according to the value of the target customer segment.

An experienced SaaS marketing agency will adjust their marketing strategies and budget allocations by linking campaign results to the lifetime values of segments for which they are looking to acquire leads.

How to Calculate LTV (Customer Lifetime Value)?

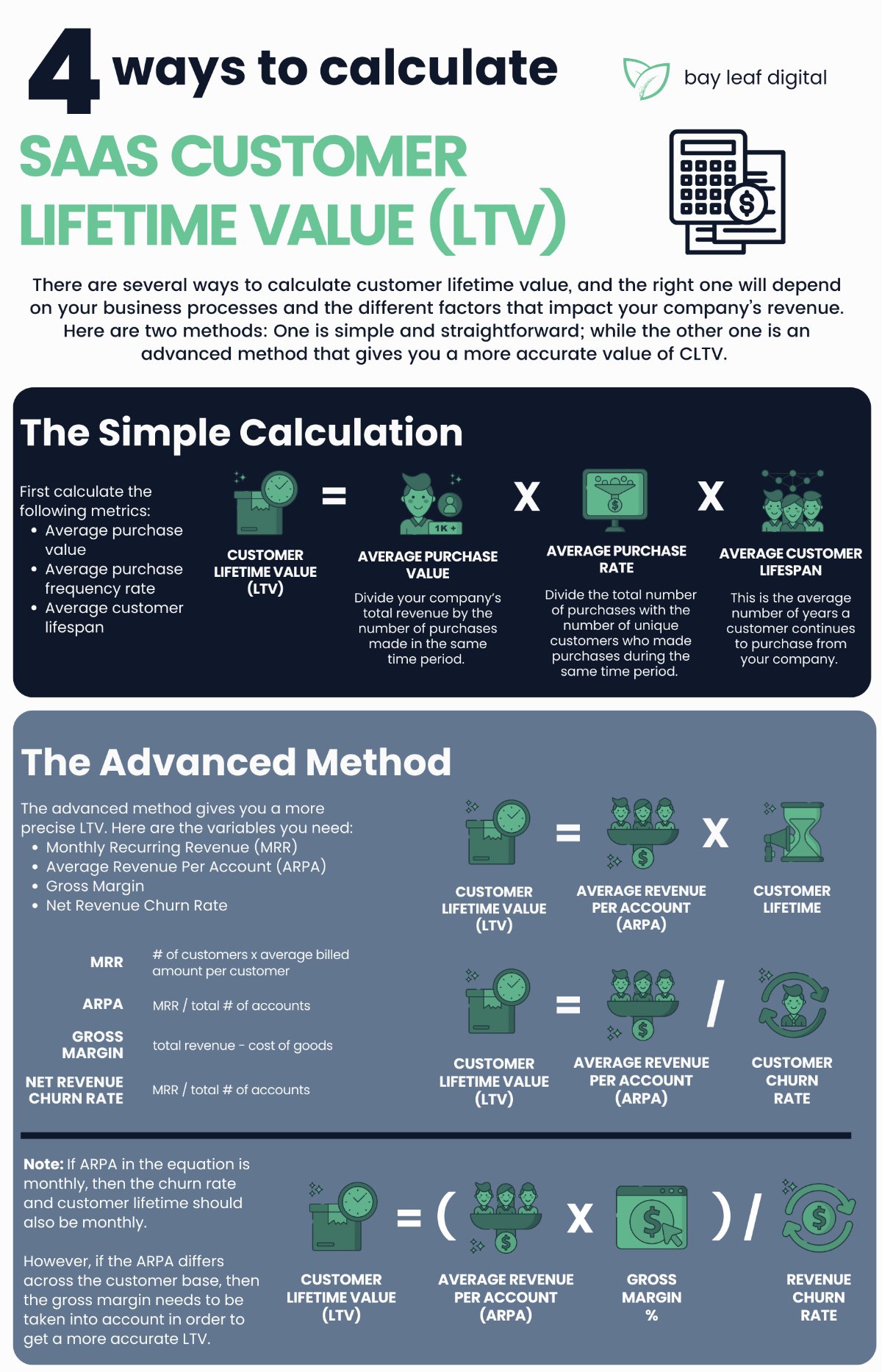

There are several ways to calculate customer lifetime value, and the right one will depend on your business processes and the different factors that impact your company’s revenue. We will be discussing two methods here. One is a rather simple and straightforward, while the other one is an advanced method that gives you a more accurate value of LTV.

Method #1: The Simple Calculation for Customer Lifetime Value

For this, you first need to calculate the following metrics:

-

Average purchase value:

Divide your company’s total revenue by the number of purchases made in the same time period.

-

Average purchase frequency rate:

Divide the total number of purchases with the number of unique customers who made purchases during the same time period.

-

Average customer lifetime:

This is the average number of years a customer continues to purchase from your company.

Calculating the Customer Lifetime Value (LTV):

Average purchase value x Average purchase rate x Average Customer Lifetime

Method #2: How to Calculate LTV to Be More Precise

The advanced method has more variables but it also gives you a more precise LTV. Here are the variables involved:

-

Monthly Recurring Revenue (MRR):

MRR = Number of Customers x Average Billed Amount Per Customer

It is the recurring revenue that your SaaS company makes in a month. It helps to average out your pricing plans and billing periods into a single consistent metric that you can track over time.

-

Average Revenue Per Account (ARPA):

ARPA = MRR/ Total number of accounts

It is the revenue generated per account. In most businesses, a single customer can have several accounts and that’s how ARPA is different from MRR. Calculate ARPA at the recurring period interval that your SaaS business works at.

-

Gross Margin:

Gross Margin = Total Revenue – Cost of Goods

Your gross margin is the total revenue the company generated minus the cost of goods, which in the case of a SaaS company can include the cost of operations and support services.

-

Net Revenue Churn Rate:

Net revenue churn rate = (Revenue lost in a specific period – upsells in that specific period) / Revenue at the beginning of the period

The net revenue churn rate is the percentage of revenue that you have lost from existing customers in a specific period of time.

Calculating the Customer Lifetime Value (LTV) using ARPA:

In a situation where ARPA is roughly the same for all customers and there isn’t any expansion revenue expected over the customer lifetime, LTV can be calculated as:

LTV = ARPA x Customer Lifetime

Or

LTV = ARPA/ Customer Churn Rate

It is important to note that if ARPA in the equation is monthly, then the churn rate and customer lifetime should be monthly as well. However, if you care about being profitable vs being growth focused, apply a gross margin percentage to the equation. This will ensure that you are viewing LTV in terms of profit, and not in terms of revenue.

LTV = (ARPA x Gross margin %) / Revenue Churn Rate

Final Words on How to Calculate LTV

If you are a small SaaS company, focus on simplicity. Don’t take shortcuts in determining how to calculate LTV, but also don’t spend months determining this answer because LTV is one cog in a bigger machine that needs to turn to make you money. Start by calculating LTV in the simplest way possible with all the metrics that you can gather. As your business grows, you will be able to acquire more customer data which will help you in calculating LTV more accurately as well as conducting more in-depth SaaS analytics.